What is lifestyle switching?

Lifestyle switching is sometimes known as phased, protective, automatic or default switching.

Pension savings are gradually moved out of higher risk funds (investing in assets such as shares) into lower risk funds (such as cash).

Lifestyle switching normally starts five years before the chosen pension date. By the time the chosen pension date arrives, all pension savings will be invested in lower risk funds.

Some pension plans move all pension savings out of a higher risk fund into a lower risk fund in one go. For example, pension savings may be switched two years before the chosen pension date.

Lifestyle switching aims to reduce the impact of short term falls in the value of pension savings in the run up to your chosen pension date.

This option will have been selected by you, your employer or the trustees of the pension scheme, normally when the plan was set up. You can normally add or remove lifestyle switching at any time.

Some pension plans exclude investments in the unitised with-profits fund from lifestyle switching in order to protect valuable guarantees.

If you are paying into your pension plan, you should review where future payments are invested when lifestyle switching kicks in. Unless you ask us to redirect payments to another fund, they will continue.

An example of how lifestyle switching might work

The way lifestyle switching works depends on the type of pension plan you bought.

In this example, each month units are automatically switched, without charge, from medium or high risk funds into a lower risk fund. This will continue each month so that after five years all the pension savings are invested in lower risk funds.

To find out how lifestyle switching works on your own pension plan (where the option is available), please contact us.

Benefits and risks of lifestyle switching

Benefits

- Moving to a lower risk fund reduces the impact of falls in the stock market close to your chosen pension date.

- Moving your pension savings gradually reduces the risk of switching at a single point when the market price is low.

- Moving your pension savings gradually means that savings remaining in the higher risk fund benefit from any future growth.

Risks

- Lifestyle switching targets your chosen pension date. If you access your pension savings before or after that date, there is the possibility of funds not being switched at the right time. You might be investing in lower risk funds too early or higher risk funds for too long.

- You may miss out on future growth if financial markets produce strong returns.

- Inflation may reduce the buying power of your pension savings and impact your future income. A low risk fund with lower growth potential may not always outperform inflation.

id

How does lifestyle switching affect performance?

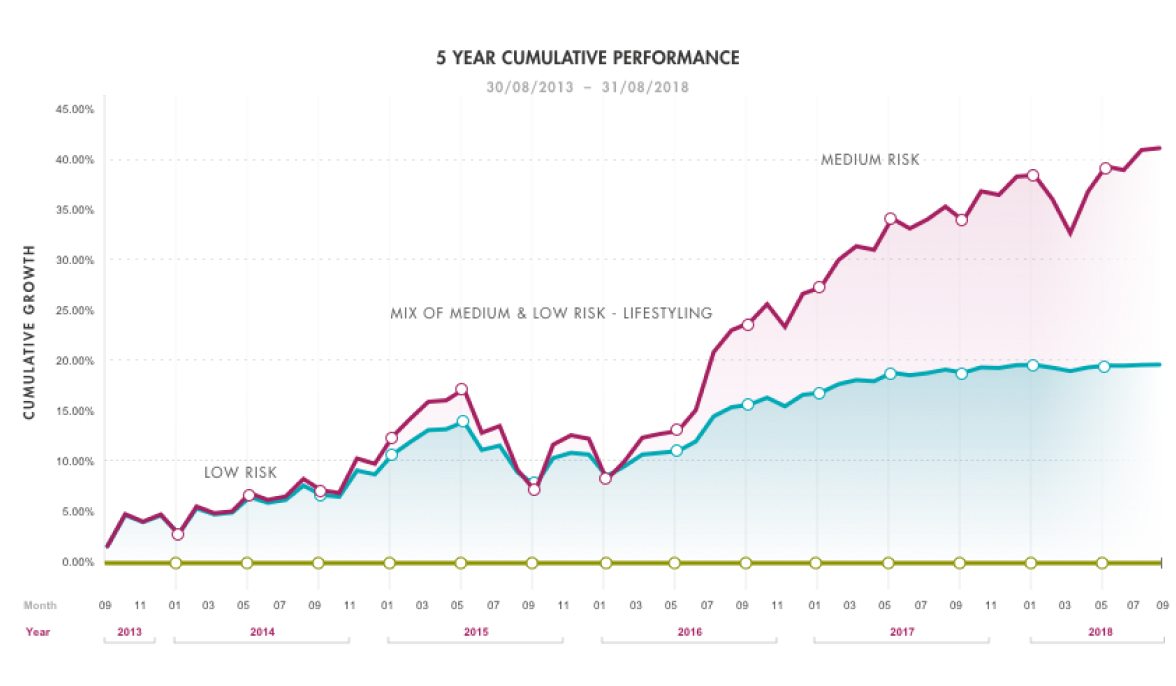

This example shows the performance of low and medium risk funds over 5 years compared to lifestyle switching.

Notes:

- This information refers to the past.

- Past performance is not a reliable indicator of future performance.

- The value of investments is not guaranteed and can go down as well as up.

- The example is based on the average performance of a range of pension funds in each sector across pension companies who belong to the Association of British Insurers.

- Lifestyling assumes a monthly switch from medium risk to lower risk investments over a 5 year period.

- The graph shows bid to bid prices and income re-invested.

-

Investment choices

We recommend you regularly review where your pension savings are invested

-

Deciding where to invest

Things to think about when deciding where to invest

-

Contact us

We’re here to help you